Corporate information

STATEMENT TO POTENTIAL INVESTORS

TO WHOMSOEVER IT MAY CONCERN

Dear Potential Investor(s),

We are seeking investment into our company for expansion of our projects which we have got approval from GOVERNMENT OF INDIA under MAKE IN INDIA and also from various governments in different countries – INDIA, USA, Canada, Mexico, Argentina, Brazil, England, France, Germany, Switzerland, Netherlands, Belgium, Finland, Sweden, Australia, Japan, Hong Kong, China, Malaysia and many others. The project is being setup in MUMBAI -PUNE region through Delhi Mumbai Industrial Corridor (D M I C) Maharashtra Industry Development Corporation (M I D C). This is a ULTRA MEGA PROJECT status provided by the Government of INDIA as well as State Government of Maharashtra. The reason for setting up in Mumbai – Pune region is because of huge amount of good talent pool availability for such a project requirement. This project would be generating around 10,000+ jobs in INDIA and more than 100,000+ jobs outside INDIA in various countries across the globe. This project services, product and solutions would be setup and provided in more than 100+ countries across the globe. The total investment into the project is more than US 10+ billion dollars.

The funding is for projects – Next Generation ATM and KIOSK manufacturing and complete end to end solutions, Data Center, Industrial Robotics, Microprocessor Chip Manufacturing.

As the world is advancing, we are attempting to recognize and fulfill the needs of our investors in terms of world-class technology solutions, services and products. By maintaining a team of capable individuals, who are constantly pushing the frontiers of industry and modern facilities, we ensure a futuristic approach that keeps up with the changing dynamics of the business world. It is our target to stay one step ahead of the expectations of our potential customers and ensure them the best arrangement in terms of business ecosystem.

Next generation ATM & KIOSK and complete end to end solutions are a complete manufacturing of the product and not assembling of such products. Apart from this there would be complete end to end ATM & KIOSK smart e-gallery digital solutions without human’s intervention, complete financial solutions, security, AI, Block chain and many other features.

Next generation AI, IOT and Block chain based Data Center solutions with features also like cloud solutions with huge data setup, collection, deployment and security across more than 100 countries across the globe.

Next generation based Industrial robotics manufacturing and solutions for various manufacturing industries, healthcare and technology driven industries.

Next generation based Microprocessor fabrication using built-in AI, IOT support, Block chain to be used for complex next generation quantum technology solutions and would be used for any of the electronic gadgets like mobile phone, TV, laptop, desktop, server and many other electronic devices.

Investment into the company would be done through a JVA company and JVA bank account. The investor would get 49% stake into the JVA Company and Brindley Technologies would owe 51% stake into the company. There would be an agreement between a JVA company and Brindley Technologies for funding of project. Whenever the funds are required for the project, the JVA Company would funds the Brindley Technologies. The investor should bring in clean funds into the JVA Company and JVA bank account. The investors should state their terms of engagement for investing their funds into the projects.

We are looking forward to hear from you.

Thank You.

Mr. Ninaad Mehta.

Founder and Managing Director

VISION AND MISSION STATEMENT TO STAKEHOLDERS

As a BRINDLEY TECHNOLOGIES, we believe in the principles of good governance and minority shareholder rights. We have always endeavored to play the role of a responsible guardian of an institution that the entire world would be proud of.

My endeavor as Founder and Managing Director has always been to establish a culture and processes that promote effective board governance to create long term stakeholder value, sustainable profits and growth.

For the BRINDLEY INDUSTRIES (B.I.G) to prosper as an institution, it is important that the management of individual companies, their boards, the management and the shareholders of the group, all work harmoniously within a robust governance framework, that in substance and form, protects the rights of all stakeholders, including shareholders, investors and the BRINDLEY INDUSTRIES GROUP’s employees, who represent the strongest asset of the Group.

The objective of the group is to innovate and deliver best of the technology products, services and solutions for the world and as a social responsibility generate millions of jobs across the world for the talented people.

“I believe it is now time that all of us work together for sustainable growth and development of the Group, an institution that we all cherish.

-Mr. Ninaad Mehta

Founder and Managing Director.

1) What is the area of operation of Brindley Technologies?

Brindley Technologies Limited (BrindleyTech) – along with its majority owned and controlled subsidiaries – is a leading global consulting, IT services, Data Center, Infrastructure Services and Product Engineering firm. The company provides end-to-end business solutions that leverage technology. The company provides solutions that span the entire software life cycle encompassing consulting, technology, engineering, and outsourcing services. In addition, the company offers KIOSK, software products and platforms.

2) Where and in which year was Brindley Technologies incorporated?

Brindley Technologies was incorporated in 2012 as Brindley Technologies Private Limited, a private limited company under the Indian Companies Act, 1956. It changed its name to Brindley Technologies Limited in April 2016, to Brindley Technologies Limited in May 2016, when it became a public limited company. Brindley Technologies is exploring its initial public offering of equity shares in India, USA and other parts of the world through FDI, Equity and other offering tools.

3) What is the revenue and profit CAGR of Brindley Technologies?

Brindley Technologies CAGR and other revenue details provided in the valuation report published in August 2016.

4) What is the employee strength of the Brindley Technologies Group?

Brindley Technologies and its subsidiaries had 1000+ employees as of October 31, 2016.

5) Does the company have debt in its balance sheet?

Brindley Technologies is a debt-free company. It doesn’t have any outstanding debt or fixed deposits. The company presently generates sufficient cash internally to finance all its operational, financing and investment requirements.

6) What is the credit rating of the company?

The credit rating of the company as per CRISIL – S&P is AVERAGE.

7) How many software development centers does Brindley Technologies have?

Brindley Technologies has 15 global development centers as on September 31, 2016, of which 2 are in India and 13 are outside India.

8) How many sales offices does Brindley Technologies have?

Brindley Technologies has 15 sales offices around the world as on September 31, 2016, of which 2 are in India and 13 are outside India.

9) Is there any Merger and Acquisition planned or in pipeline?

Brindley Technologies have couple of merger and acquisition worked out. Some of them are in advance state and few of them are in final stage of acquisition. 2020 is the year we see couple of mergers and acquisition happing into the Brindley Technologies Group to grow the company inorganically globally.

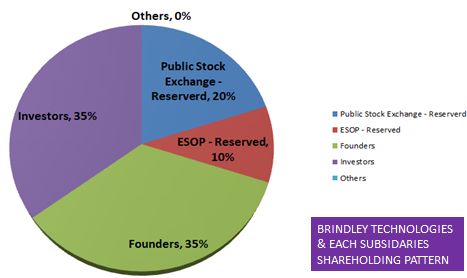

10) What is the shareholding pattern for the company?

Investors shareholding is for investors who will invest in our subsidiaries companies.

Total valuation and projection for next 10+ years is USD 1 trillion dollars.

This is a expansion project as we are already working on it. The company is already unlisted public in India. The company already is going public listing on BSE/NSE in next 2-3 years for IPO & FPO.

Hence equity split is

35% for investors

35% for promoters

20% for IPO / FPO reserved for dilution

10% for ESOP reserved for dilution

These project are 100% supported with PLI, incentives & subsides by Government of India, Minsitry of Corporate, Ministry of IT Electronics & Telecom, NASSCOM, Government of Maharashtra, Dept of Industries, Dept of Labour, MIDC , DMIC and other agencies in India.

Hence investors money is not going to be wasted.

50% of funds is no risk as investors money will be converted into asset.

There is not huge risk on these project as investors may be thinking. There is only risk of working capital which is 40%-50% initially.

All our projects are GOLD & DIAMOND MINE OF 21st Century.

a. Semiconductor foundry

b. Semiconductor labs

c. Semiconductor manufacturing & packaging

d. Data center & cloud computing and ecosystems

e. Industrial robots & Cobots and ecosystems

f. ATM, kiosk and ecosystems

11) What is the address of the registered office of Brindley Technologies?

The address of the registered office of Brindley Technologies is as below.

Brindley Technologies Limited,

12, Kadambari, Sanatorium Lane, MV Road, Andheri East, Mumbai, Maharashtra, INDIA

Pin Code: 400069.

Website: www.BrindleyTech.com

Brindley Technologies Inc.,

19 W. 34th Street Suite 1018

New York, NY 10001

United States

Website: www.BrindleyTech.com

Brindley Investment Limited,

Unit 25A, 25F, Wing Hing,

Commercial Building, 139 Wing,

Lok Street, Sheung Wan,

Hong Kong

10) When does the financial year of Brindley Technologies end?

The Brindley Technologies financial year ends on March 31.

Investor contact information

11) Investor contact

For queries relating to financial statement:

India Fillings, C.A Charles & Associates, India

Company Chartered Account (CA).

Email: accounts@BrindleyTech.com

Potter & Co., USA

Company Chartered Public Accountant (CPA).

Email: accounts@BrindleyTech.com

For investor matters:

India Fillings, C.A. Charles & Associate, India

Financial Controller and Head – Investor Relations

Email: investors@BrindleyTech.com

Mrs. Yamini Mehta,

Financial Adviser

Email: investors@BrindleyTech.com

Registrar and share transfer agents:

India Fillings, India

Company Secretary

Email: cs@BrindleyTech.com

For Financial Advisory & Investment Consultant into the group:

Brindley Investment Limited

Unit 25A, 25th Floor,

Wing Hing Commercial Building,

139 Wing Lok Street,

Sheung Wan, Hong Kong

Financial Advisor

Email: investors@BrindleyTech.com / investor@BrindleyInvestment.com

Name and address of the depositary bank for the purpose of ADS:

In India

State Bank of INDIA. Mumbai, INDIA

YES Bank Ltd. Mumbai, INDIA

In the US

HSBC, New York, NY, USA

Stocks |

|

|

– |

|

– |

|

– |